On the first day of the new year, 5 robot-related companies lifted the ban on stocks, and the total market value = 2 Jiangsu Beiren

Unknowingly, the sound of firecrackers in the New Year of 2021 has faded away, and the struggle has started again. On the first day of the new year on February 18, many robot companies started their own new journey. Among them, five robot industry related companies announced the lifting of the stock ban, which started the capital market.

01 Harbin Industrial Intelligence lifted the ban on 137 million shares

Harbin Industrial Intelligence has lifted the ban and listed 137 million shares. The lifted shares are private placement shares, accounting for 17.99% of the company's total share capital. It is the company with the largest number of shares lifted this time. According to the closing price of 6.65 yuan per share on the afternoon of February 18, the market value of the lifted stock is about 900 million yuan.

After lifting the ban, Harbin Industrial Intelligence still has 25,642,400 restricted stocks.

The main business of Harbin Engineering Intelligence is the research and development, design, manufacturing and sales of intelligent flexible production lines and automated control systems for automobile bodies; the main products are complete vehicle welding production lines and renovation projects and fixtures. The operating income of Harbin Industrial Intelligence in 2020 is expected to be 1.55-165 billion yuan, and the net profit is between 0-1 million yuan.

In 2021, on the basis of the original, Harbin Engineering Intelligence sets the sales target of robots at 2,000 units. At the same time, the puncture robot developed by its subsidiary, Pound Kece through technological innovation, has also entered the clinical stage, and is expected to become a new company for Harbin Engineering Intelligence. Send and receive power points.

02 Wanfeng Aowei lifts 111 million shares ban

On February 18, Wanfeng Aowei officially announced that it had recently completed the de-pledge registration procedures for some of its unrestricted tradable shares with China Securities Depository and Clearing Co., Ltd. This time, it has released 111 million shares from the pledge. It accounts for 15.21% of the company's shares held by it.

vacuum coating machine,pvd coating machine,pvd vacuum machine,vacuum ion coating machine,multi-arc ion coating machine

It is understood that the stocks that were released this time were pledged on April 8, 2016, May 24, 2018, and September 14, 2018. The pledgee was the Export-Import Bank of China. After the pledge was lifted, the percentage of the pledged shares of Wanfeng Group in the company's total equity dropped to 13.14%, and the pledge rate dropped to 39.39%. In addition, among the important shareholders, Chen Ailian still holds 3.63% of the company's total share capital under pledge.

Calculated based on the closing price on February 18, the market value of the stocks lifted this time exceeded 600 million yuan.

Wanfeng Aowei is engaged in the business of aluminum alloy wheels, environmental protection Dacromet coating, lightweight magnesium alloy and die stamping parts. The main products are automobile wheel manufacturing, motorcycle wheel manufacturing, magnesium alloy die-casting products, coating processing, and metal castings; It is the first intelligent manufacturing enterprise in the global motorcycle aluminum alloy wheel industry.

In the field of intelligent equipment, Wanfeng Aowei products mainly cover industrial robots, low-pressure (differential pressure, gravity) casting machines, industrial furnaces and foundry automation system integration. Wanfeng industrial robots have formed more than 10 product layouts of 6~400kg series, involving casting, handling, grinding, machining loading and unloading, welding, palletizing and other application fields.

Up to now, Wanfeng Aowei has provided intelligent equipment and automated production lines for enterprises and institutions such as Bailian Group, Nimaco, Sany Heavy Industry, China National Heavy Duty Truck, National Nuclear Power, Hangzhou Development Group, etc.; its American PASLIN company is a global leader Of welding automation integrators and arc welding automation experts.

03 Funeng Oriental lifts the ban on 52.459 million shares

On the same day, Funeng Oriental also had 52.459 million shares lifted and listed for circulation, accounting for 7.14% of the company's total equity. After the lifting of the ban, Funeng Dongfang still has 96,086,200 shares in pledge status, which will be held on June 2, 2321 (50,914,300 shares), February 18, 2022 (13,114,800 shares), and June 2, 2023 (3205.71). Ten thousand shares) lifted the ban.

The stocks lifted this time and the stocks to be lifted in the next three years are all private placement shares; calculated at the closing price on February 18, the market value of the stocks lifted is approximately 285 million yuan.

vacuum coating machine,pvd coating machine,pvd vacuum machine,vacuum ion coating machine,multi-arc ion coating machine

It is understood that Funeng Dongfang is mainly engaged in the research and development, production and sales of high-end intelligent manufacturing equipment. With its high-quality products and comprehensive sales services, it has established a leading position in the 3C intelligent special equipment industry such as precision engraving machines and hot bending machines. The 3C field has also become its main source of revenue, accounting for about 97% of its total revenue.

Its subsidiary, Shenzhen Daewoo Jingdiao, has its main line of 3C consumer electronics smart equipment and robotic automated production line business represented by engraving machines, sweeping machines, drilling and tapping machines. It has gradually transitioned from the original single equipment production and sales to the entire Provider of R&D, equipment supply and supporting services for all production lines.

On June 11, 2018, Daewoo Jingdiao officially launched the first "intelligent glass cover production line" in China. With this set of equipment, customers can basically achieve black light operations in the glass cover workshop.

Benefiting from the gradual recovery of the 3C automation equipment business segment of Daewoo Jingdiao, the overall revenue of Funeng Dongfang in 2020 is expected to be 71~1.065 billion yuan, of which the net profit forecast range is 11~16.5 million yuan.

04 Risong Technology lifted the ban on nearly 30 million restricted shares

Since February 18, 29,430,753 restricted shares of Risong Technology for 12 months have been officially lifted. This is part of Risong Technology’s initial public offering of restricted shares, involving 18 shareholders of restricted shares, accounting for the company’s total share capital. 43.69%.

According to the closing price on February 18, the total market value of the stocks released this time is about 980 million yuan. Although the stocks of Risong Technology's lifting of the ban are not the most one of the five companies introduced in this article, it is the company with the largest new market value.

It should be noted that, among the stocks of Risong Technology that are listed and circulated this time, except for the parts that cannot be sold due to equity pledges and executive bans, they can actually be sold on the market for 21.52 million shares, accounting for 31.95% of the total equity.

vacuum coating machine,pvd coating machine,pvd vacuum machine,vacuum ion coating machine,multi-arc ion coating machine

Risong Technology’s main business is R&D, design, manufacturing, application, sales and service in the field of robotics and intelligent manufacturing. Its main products include robotic automated production lines, robotic workstations, and robotic accessories sales. It has won the "Best Supplier Award for Intelligent Manufacturing System Integration" ", "Top 500 Manufacturing Industries in Guangdong Province" and other honors.

It is understood that Risong Technology is a typical “market-for-technology” incubation in the automotive industry. It has long been an important supplier of international mainstream vehicle manufacturers and has accumulated a large number of advanced technology and application cases. Through its own research and development, it has mastered some of the achievements. Main technical applications at the mainstream level in China.

It is particularly worth mentioning that its senior management team are all born in the 60s, and they are all masters, which belong to the scholar-type talent team.

In the first three quarters of 2020, Risong Technology's total revenue was 648 million yuan, a year-on-year increase of 33.02%, and its net profit slightly exceeded 42.03 million. Analyzing its revenue performance in recent years, its revenue and net profit in 2020 may set new highs in recent years.

05 Dahua released 33.15 million shares

Dahua, the parent company of Huarui Technology, which focuses on machine vision and AGV, also announced the release of the pledge of equity on the same day. Among them, the actual controller Fu Liquan released 23.2 million shares of pledged shares, and the shareholder Zhujiang Ming released 9.95 million shares of pledged shares, totaling 33.15 million shares. Based on the closing price on February 18, the market value of the released shares was approximately 760 million yuan.

Dahua Co., Ltd. is one of the leading security companies in my country. As early as 2016, it began to deploy robots and established Huarui Technology. It mainly deals in the production, software development, and technology of industrial cameras, supporting lenses, automated inspection equipment, and automated production equipment. Service etc.

In July 2020, Dahua Co., Ltd. acquired all the shares of its subsidiary Dahua Robot for RMB 7,004,900, and transferred all its robotics business and subsidiary Dahua Robotics on November 16, 2020 at a price of RMB 40.275 million. Give Huarui Technology more support to the latter.

vacuum coating machine,pvd coating machine,pvd vacuum machine,vacuum ion coating machine,multi-arc ion coating machine

# Summary

After the relevant stocks of the above five companies were lifted, the total market value involved exceeded 3.5 billion yuan based on their respective closing prices on February 18, which is equivalent to one Huazhong CNC (total market value of 3.526 billion yuan on February 18) or two Jiangsu North People (total market value of 1.768 billion yuan on February 18), lifting the ban on such a large number of stocks in one day is quite rare in the local robotics industry.

Not only that, on the first day of the new year, the stock market was also dominated by popularity. Zhuoyi Technology, Topstar, Huachangda, Boshi, Mitutoyo Intelligent, etc. led the bull market and opened up the prosperous start of the Robot Ox Year.

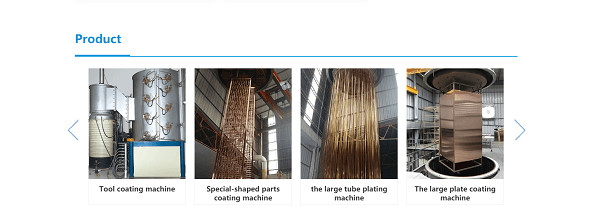

Founded in 2015,Zunhua Baorui Titanium Equipment Co.,Ltd. is a manufacturer specializing in pvd vacuum ion coating equipment. The company’s products mainly include large plate coating machine, large tube collating machine, tool coating machine and LOW-E glass production line. Mr.Wang baijiang ,general manager of the company ,has been engaged in vacuum coating industry for more than 30 years. He continuously improve production technology, improve product performance and devote himself to provide customers with better product experience and higher production efficiency.